Business

Unite BVI Launches 2024 KickStart BVI Small Business Loan Programme

Unite BVI has officially launched the 2024 KickStart BVI Small Business Loan Programme, an initiative aimed at bolstering the British Virgin Islands’ economic growth by supporting local entrepreneurs with financial aid and resources.

This year’s programme continues its commitment to fostering social impact businesses that contribute positively to the community or environment.

The KickStart BVI programme offers zero-interest loans of up to $5,000 with a two-year repayment period. In addition to the financial boost, participants will receive free training, mentorship, and access to networking opportunities. Notably, no down payment or collateral is required, making the loan accessible to a broad range of small businesses across the territory.

Since its inception six years ago in partnership with VP Bank, KickStart BVI has grown to include collaborations with HIRE BVI, IGNITE, and the Branson Centre of Entrepreneurship Jamaica. These partnerships provide crucial training and development resources to the programme’s participants. Unite BVI is also working alongside the Ministry of Financial Services, Labour, and Trade to deliver comprehensive mentorship and business development support.

To qualify, interested entrepreneurs must complete an initial assessment survey available online. The deadline for submissions is September 13, 2024. Successful applicants will then be invited to submit a detailed business plan and financial forecast.

Kim Takeuchi, Foundation Manager at Unite BVI, highlighted the programme’s focus on social impact enterprises, emphasizing the long-term benefits to the BVI community and environment. “The KickStart BVI programme is about more than just financial support; it’s about fostering a vibrant entrepreneurial culture that drives social, environmental, and economic change,” said Takeuchi.

Business

Caribbean Shipping Secures Exemption from U.S. Port Fees on Chinese-Built Vessels

The Office of the United States Trade Representative (USTR) has exempted Caribbean shipping routes from newly proposed port fees on Chinese-built vessels. This decision follows concerted advocacy by the Caribbean Private Sector Organisation (CPSO) and regional stakeholders, who warned that the fees could have devastating economic consequences for the Caribbean.

The USTR’s initial proposal aimed to impose fees of up to $1.5 million per port call on vessels constructed in China, as part of a broader strategy to counter China’s dominance in global shipbuilding and bolster the U.S. maritime industry. However, the policy faced immediate backlash from Caribbean nations, where a significant portion of shipping relies on Chinese-built vessels.

Dr. Patrick Antoine, CEO and Technical Director of the CPSO, testified at a USTR public hearing, emphasizing that over 90% of CARICOM’s trade in goods depends on maritime transport. He warned that the proposed fees could lead to a 60% increase in shipping costs to and from the Caribbean, severely impacting economies where more than 50% of the ships are Chinese-built.

The potential repercussions were particularly alarming for smaller Caribbean states like Antigua and Barbuda, Dominica, Grenada, St. Lucia, and St. Vincent and the Grenadines, which rely heavily on short-sea shipping routes serviced by Chinese-built vessels. Prime Minister Gaston Browne of Antigua and Barbuda expressed concern that shipping a container could increase by $3,000 to $4,000, leading to an 8–10% rise in consumer prices and pushing inflation rates to potentially 12–14%.

In response to these concerns, the USTR revised its policy to exempt ships operating between U.S. domestic routes, the Caribbean, U.S. territories, and Great Lakes ports from the new fees. This adjustment aims to prevent inflation, supply chain disruptions, and surging trade costs in the region.

The exemption has been met with relief across the Caribbean. Dr. Antoine expressed gratitude to the USTR for recognizing the unique challenges faced by Caribbean economies and for taking steps to safeguard regional trade stability.

While the exemption provides immediate relief, regional leaders and industry stakeholders continue to monitor the situation closely. They advocate for long-term strategies to enhance the resilience of Caribbean supply chains and reduce dependency on external factors that could disrupt trade.

Business

BVI Braces for Ripple Effects as U.S. Stock Market Sheds $5 Trillion

In just three weeks, the U.S. stock market has lost a staggering $5 trillion in value, a downturn that could have significant implications for the British Virgin Islands (BVI), where the U.S. dollar is the official currency. As economic uncertainty grips the global financial system, concerns are mounting over how this sharp decline might impact the BVI’s economy, particularly in the areas of tourism, offshore financial services, and overall consumer confidence.

With the U.S. being the primary source of visitors to the BVI, any financial squeeze on American households could lead to a reduction in travel plans. A weaker U.S. stock market often means tighter budgets for vacationers, which could result in lower visitor numbers, reduced hotel bookings, and fewer yacht charters—critical sectors for the territory’s economy.

As one of the Caribbean’s leading offshore financial hubs, the BVI is deeply connected to global markets. A drop in stock values can shake investor confidence, potentially leading to slower financial transactions, reduced incorporations, and a cautious approach from high-net-worth individuals who use BVI-based structures for wealth management.

With the BVI using the U.S. dollar, economic shocks in the U.S. can quickly affect the cost of goods and services in the territory. A weaker U.S. market could lead to fluctuations in inflation, making imports more expensive. For a territory that relies heavily on imported goods—from food supplies to construction materials—this could put additional pressure on businesses and consumers.

The BVI government will likely keep a close watch on these developments, as a prolonged U.S. market downturn could impact tax revenues, business activity, and overall economic confidence. Policymakers may need to explore ways to strengthen economic resilience, whether through increased regional trade, diversification efforts, or measures to support local businesses in uncertain times.

While the full impact of this financial slide remains to be seen, one thing is certain: the BVI, like many other U.S. dollar-dependent economies, is paying close attention to Wall Street’s turbulence and preparing for potential economic headwinds.

Business

Tropical Shipping Warns of Severe Impact on Caribbean Trade from Proposed U.S. Tariff on Chinese-Built Vessels

A proposed tariff set to be enacted by the United States government next month threatens to unravel decades of economic ties between the U.S. and the Caribbean. The new policy, which would impose a hefty $1 million port fee on any Chinese-built vessel calling at U.S. ports, could raise shipping costs by thousands of dollars per container, potentially shifting the flow of goods between the U.S. and the Caribbean to foreign competitors. For Caribbean exporters, this tariff would be a major blow, raising the cost of goods and disrupting established trade relationships that total $92.3 billion annually.

While the United States government has framed the proposal as a trade measure aimed at countering unfair practices, it will have profound implications for Caribbean economies that depend on efficient, cost-effective shipping services to move goods. Most of the vessels serving the region were built in China, meaning the vast majority of Caribbean trade will be directly impacted by this policy.

For Caribbean businesses, the stakes are high. With rising shipping costs, many companies could be forced to either absorb the additional costs or pass them along to consumers. Both scenarios are unsustainable. Higher prices on exports to the Caribbean would make American goods less competitive, pushing businesses in the region to turn to other nations for supplies. The result? U.S. exports to the Caribbean could plummet, damaging a $92.3 billion trade relationship and costing both U.S. and Caribbean businesses valuable market share.

The proposed tariff will also hurt the livelihoods of many Caribbean workers who rely on a robust, affordable shipping network to support industries like agriculture, manufacturing, and retail. Rising shipping costs could result in fewer goods reaching the islands, driving up prices and making it harder for businesses to operate. For smaller Caribbean economies, the impact could be even more severe, as many rely heavily on U.S. imports for basic goods and supplies.

Tropical Shipping, a key player in U.S.-Caribbean trade, has raised its voice against the U.S. Trade Representative’s (USTR) proposal, warning of the far-reaching consequences for both American and Caribbean workers. “This tariff will not only raise costs for Caribbean businesses but will hurt American workers as well,” said Tropical’s President and CEO in a letter to the USTR. “American workers in port operations, warehousing, trucking, and logistics will feel the impact, while exporters from the U.S. will find themselves less competitive compared to foreign rivals.”

At its core, the proposal threatens to destabilize Caribbean economies by driving up the cost of goods exported from the U.S. and weakening the region’s reliance on U.S. ports. The Caribbean is the United States’ largest trading partner in the Western Hemisphere, and this tariff would directly reduce the volume of goods passing through U.S. ports, ultimately harming jobs in both regions. It would also make it increasingly difficult for Caribbean countries to maintain consistent access to the goods they need, further straining already delicate economic conditions.

The Caribbean’s stake in this decision is clear. Tropical Shipping is urging businesses and individuals across the region to submit comments to the USTR, outlining how this tariff would affect their operations. This simple step could be a turning point, helping to prevent a trade policy that could ultimately disrupt the flow of goods between the U.S. and the Caribbean.

For more information about the USTR Section 301 proposal and how to submit your comments, visit the USTR Public Comment Page.

Tropical Shipping remains committed to protecting the interests of both Caribbean businesses and American workers, recognizing that both regions are interconnected in ways that cannot be ignored. The outcome of this decision could have lasting consequences for U.S.-Caribbean trade — a relationship that is essential to both economies’ continued prosperity.

-

Uncategorized3 days ago

Uncategorized3 days agoBritish Virgin Islands Regulators Move to Wind Down Bank of Asia (BVI) Limited

-

Entertainment16 hours ago

Entertainment16 hours agoK’Meeya Chung and Dakarai Wheatley-Adams Crowned Miss and Mr. HLSCC 2025

-

Entertainment3 days ago

Entertainment3 days agoNeil Frett Named Honouree as 71st Virgin Islands Emancipation Festival Officially Launched

-

Entertainment2 weeks ago

Entertainment2 weeks agoFive Students to Compete in Mr. & Miss HLSCC Pageant on June 1

-

Local News3 days ago

Local News3 days agoBVI U19 Rugby Squad Departs for Dominican Republic Development Tour

-

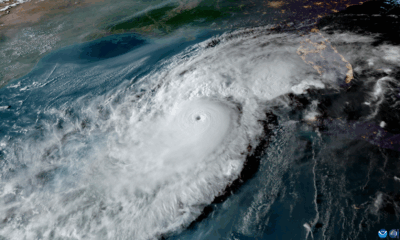

Local News1 day ago

Local News1 day agoCaribbean Braces for Active 2025 Hurricane Season

-

Uncategorized1 week ago

Uncategorized1 week agoChantel Malone Leaps to First Place Amid Headwinds at Tucson Elite Classic:

-

Education4 days ago

Education4 days agoTwelve Primary Schools Advance to Final Round of 2025 Spelling Bee