Business

MPs Criticise British Virgin Islands Over New Corporate Ownership Register

A growing rift between the British Virgin Islands (BVI) and the UK government has erupted over proposals for a new corporate ownership register, with MPs accusing the territory of attempting to shield financial criminals from scrutiny. The dispute threatens to escalate into a constitutional showdown as pressure mounts on the UK to intervene.

The controversy centres on the BVI’s proposed system for disclosing company ownership information. While overseas territories, including the BVI, have committed to introducing publicly accessible registers of beneficial ownership (PARBOs), critics argue that the new measures would render it nearly impossible to uncover the true owners of firms registered in the islands.

MPs Joe Powell and Andrew Mitchell, who co-chair the all-party parliamentary group on anti-corruption and responsible tax, have written to BVI Premier Natalio Wheatley, condemning the plan as a “shameful bid” to protect illicit financial activities. The former development minister Mitchell went further, accusing the BVI of attempting to “continue to manage stolen funds and assist in money laundering from sources close to the sex trade and the drugs trade.”

Under the BVI’s proposed system, only individuals involved in legal or regulatory proceedings related to financial crime could request ownership information. Additionally, the owners of companies would be notified of such requests and granted five days to object before any details are shared. Critics argue this provision would alert criminals to impending investigations, allowing them to move assets before authorities can act.

“This could expose journalists to legal or physical intimidation when investigating high-risk stories on drug cartels, kleptocrats, or human traffickers,” the MPs wrote in their letter. The proposals also require applicants to already know the identity of a company’s owner before requesting ownership details—an approach described as a “logical impossibility” by Mitchell and Powell.

The UK Foreign Office is reportedly dissatisfied with the BVI’s proposals and has urged the territory to revise its approach. Foreign Secretary David Lammy has prioritised efforts to combat illicit finance, with the issue of public ownership registers featuring prominently in recent talks with overseas territories. British officials made their stance clear during a summit with the territories in November.

Transparency International, a leading anti-corruption group, has echoed concerns raised by MPs, warning that the BVI’s policy could undermine global efforts to combat financial crime. Lawmakers are set to debate the progress of PARBOs in a Westminster Hall session on Wednesday, with the BVI’s approach expected to be a focal point of discussions.

There is growing speculation that the UK government could resort to an “order in council” to compel the BVI to comply. The measure, rarely used to preserve the self-governance of overseas territories, has been previously invoked to abolish the death penalty and decriminalise homosexuality in British territories.

The BVI government has declined to comment on the criticisms but has previously stated its commitment to transparency and tackling financial crime. It has argued that open registers require a “tailored approach” depending on the jurisdiction.

Source: TheGuardian.com

Business

BVI Braces for Ripple Effects as U.S. Stock Market Sheds $5 Trillion

In just three weeks, the U.S. stock market has lost a staggering $5 trillion in value, a downturn that could have significant implications for the British Virgin Islands (BVI), where the U.S. dollar is the official currency. As economic uncertainty grips the global financial system, concerns are mounting over how this sharp decline might impact the BVI’s economy, particularly in the areas of tourism, offshore financial services, and overall consumer confidence.

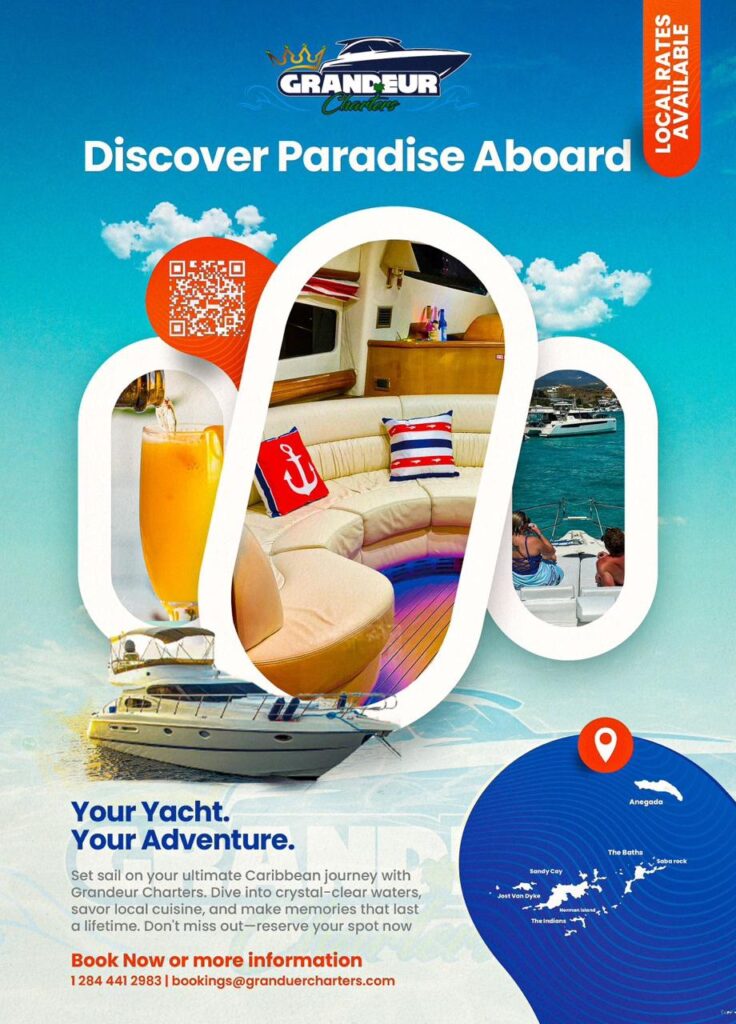

With the U.S. being the primary source of visitors to the BVI, any financial squeeze on American households could lead to a reduction in travel plans. A weaker U.S. stock market often means tighter budgets for vacationers, which could result in lower visitor numbers, reduced hotel bookings, and fewer yacht charters—critical sectors for the territory’s economy.

As one of the Caribbean’s leading offshore financial hubs, the BVI is deeply connected to global markets. A drop in stock values can shake investor confidence, potentially leading to slower financial transactions, reduced incorporations, and a cautious approach from high-net-worth individuals who use BVI-based structures for wealth management.

With the BVI using the U.S. dollar, economic shocks in the U.S. can quickly affect the cost of goods and services in the territory. A weaker U.S. market could lead to fluctuations in inflation, making imports more expensive. For a territory that relies heavily on imported goods—from food supplies to construction materials—this could put additional pressure on businesses and consumers.

The BVI government will likely keep a close watch on these developments, as a prolonged U.S. market downturn could impact tax revenues, business activity, and overall economic confidence. Policymakers may need to explore ways to strengthen economic resilience, whether through increased regional trade, diversification efforts, or measures to support local businesses in uncertain times.

While the full impact of this financial slide remains to be seen, one thing is certain: the BVI, like many other U.S. dollar-dependent economies, is paying close attention to Wall Street’s turbulence and preparing for potential economic headwinds.

Business

Tropical Shipping Warns of Severe Impact on Caribbean Trade from Proposed U.S. Tariff on Chinese-Built Vessels

A proposed tariff set to be enacted by the United States government next month threatens to unravel decades of economic ties between the U.S. and the Caribbean. The new policy, which would impose a hefty $1 million port fee on any Chinese-built vessel calling at U.S. ports, could raise shipping costs by thousands of dollars per container, potentially shifting the flow of goods between the U.S. and the Caribbean to foreign competitors. For Caribbean exporters, this tariff would be a major blow, raising the cost of goods and disrupting established trade relationships that total $92.3 billion annually.

While the United States government has framed the proposal as a trade measure aimed at countering unfair practices, it will have profound implications for Caribbean economies that depend on efficient, cost-effective shipping services to move goods. Most of the vessels serving the region were built in China, meaning the vast majority of Caribbean trade will be directly impacted by this policy.

For Caribbean businesses, the stakes are high. With rising shipping costs, many companies could be forced to either absorb the additional costs or pass them along to consumers. Both scenarios are unsustainable. Higher prices on exports to the Caribbean would make American goods less competitive, pushing businesses in the region to turn to other nations for supplies. The result? U.S. exports to the Caribbean could plummet, damaging a $92.3 billion trade relationship and costing both U.S. and Caribbean businesses valuable market share.

The proposed tariff will also hurt the livelihoods of many Caribbean workers who rely on a robust, affordable shipping network to support industries like agriculture, manufacturing, and retail. Rising shipping costs could result in fewer goods reaching the islands, driving up prices and making it harder for businesses to operate. For smaller Caribbean economies, the impact could be even more severe, as many rely heavily on U.S. imports for basic goods and supplies.

Tropical Shipping, a key player in U.S.-Caribbean trade, has raised its voice against the U.S. Trade Representative’s (USTR) proposal, warning of the far-reaching consequences for both American and Caribbean workers. “This tariff will not only raise costs for Caribbean businesses but will hurt American workers as well,” said Tropical’s President and CEO in a letter to the USTR. “American workers in port operations, warehousing, trucking, and logistics will feel the impact, while exporters from the U.S. will find themselves less competitive compared to foreign rivals.”

At its core, the proposal threatens to destabilize Caribbean economies by driving up the cost of goods exported from the U.S. and weakening the region’s reliance on U.S. ports. The Caribbean is the United States’ largest trading partner in the Western Hemisphere, and this tariff would directly reduce the volume of goods passing through U.S. ports, ultimately harming jobs in both regions. It would also make it increasingly difficult for Caribbean countries to maintain consistent access to the goods they need, further straining already delicate economic conditions.

The Caribbean’s stake in this decision is clear. Tropical Shipping is urging businesses and individuals across the region to submit comments to the USTR, outlining how this tariff would affect their operations. This simple step could be a turning point, helping to prevent a trade policy that could ultimately disrupt the flow of goods between the U.S. and the Caribbean.

For more information about the USTR Section 301 proposal and how to submit your comments, visit the USTR Public Comment Page.

Tropical Shipping remains committed to protecting the interests of both Caribbean businesses and American workers, recognizing that both regions are interconnected in ways that cannot be ignored. The outcome of this decision could have lasting consequences for U.S.-Caribbean trade — a relationship that is essential to both economies’ continued prosperity.

Business

Cyril B. Romney Tortola Pier Park Celebrates 9th Anniversary

Today marks the ninth anniversary of the Cyril B. Romney Tortola Pier Park, a cornerstone of the British Virgin Islands’ cruise tourism industry. Since its official opening on February 16, 2016, the park has become a vibrant hub for visitors and locals alike.

Construction of the Tortola Pier Park commenced in mid-2014, aiming to enhance the territory’s capacity to accommodate larger cruise ships and provide an enriched visitor experience. The project culminated in a grand opening ceremony on February 16, 2016, unveiling a modern facility featuring a blend of retail, dining, and entertainment options. The event was a significant milestone, reflecting the territory’s commitment to bolstering its tourism infrastructure.

In recognition of the late Cyril B. Romney’s pivotal contributions to the territory, particularly in the development of the cruise tourism sector, the facility was officially renamed the Cyril B. Romney Tortola Pier Park on February 15, 2019. Mr. Romney, who served as Chief Minister from 1983 to 1986, was instrumental in pioneering initiatives that have had a lasting impact on the BVI’s economic landscape.

The renaming ceremony was marked by the unveiling of a statue in Mr. Romney’s honor, symbolizing his enduring legacy. The event was attended by government officials, family members, and residents, all paying tribute to his visionary leadership and dedication to the territory’s progress.=

Over the past nine years, the Cyril B. Romney Tortola Pier Park has evolved into more than just a cruise port; it has become a cultural and social epicenter. The park hosts numerous events, including local festivals, concerts, and community gatherings, fostering a sense of unity and celebration among residents and visitors.

-

Uncategorized2 days ago

Uncategorized2 days agoJamaican National Ronnie Identified as Carrot Bay Drowning Victim

-

Uncategorized3 days ago

Uncategorized3 days agoAssaults and Wounding Charges for Huntums Ghut and Virgin Gorda Residents

-

Uncategorized3 days ago

Uncategorized3 days agoTwo Men Charged in Separate Burglary Investigations

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoPrison Officer Stabbed in Altercation at His Majesty’s Prison

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCity Takes Action on Craft Alive Rent Arrears

-

Crime/Police1 week ago

Crime/Police1 week agoPrison Superintendent Addresses Attack on Officer at Balsam Ghut

-

Local News2 days ago

Local News2 days agoMan Drowns After Being Swept Off Rocks by Wave in the Carrot Bay

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoPower Outage Affects Tortola After Infrastructure Damage